The

Chinese currency has been on a rapid upward trajectory since last November.Entering 2023, both CNY and CNH continue the stellar performance, with the 6.70

mark looming in sight.

In the

meantime, the official CNY index also climbed, with the CFETS RMB index back to

the 100 mark. The upside potential, in our view, not only indicates that the

Chinese currency would continue to appreciate, but also implies a sharp

narrowing of USD-CNY forward points. The

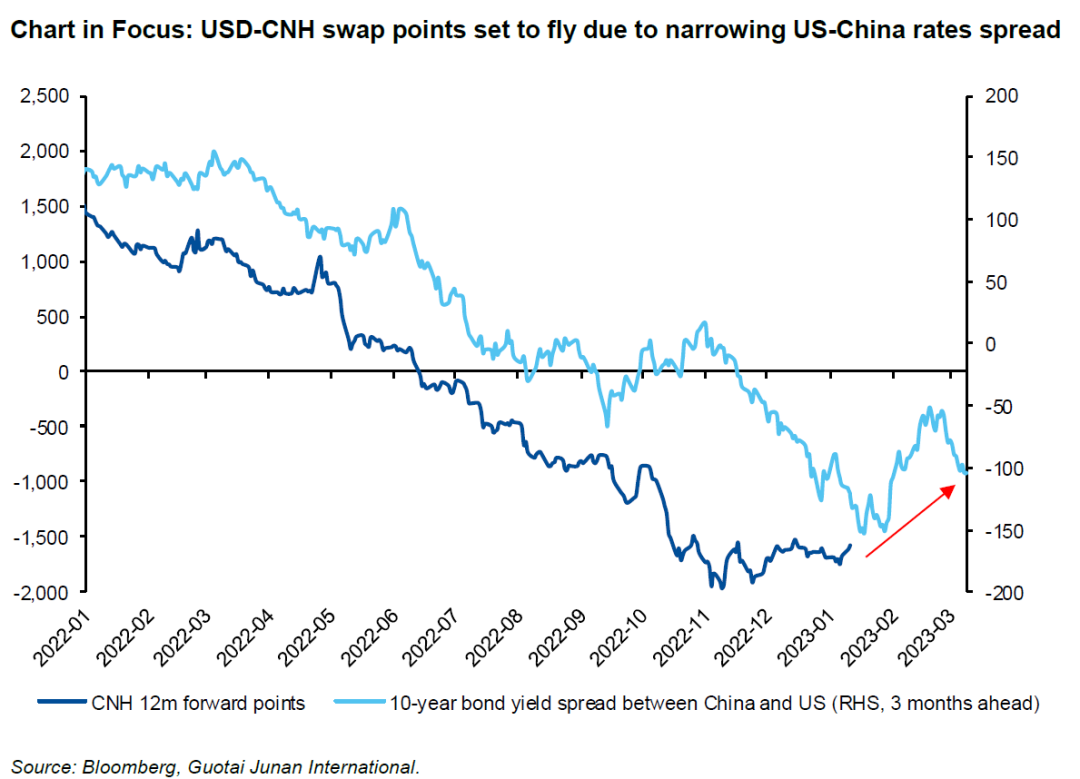

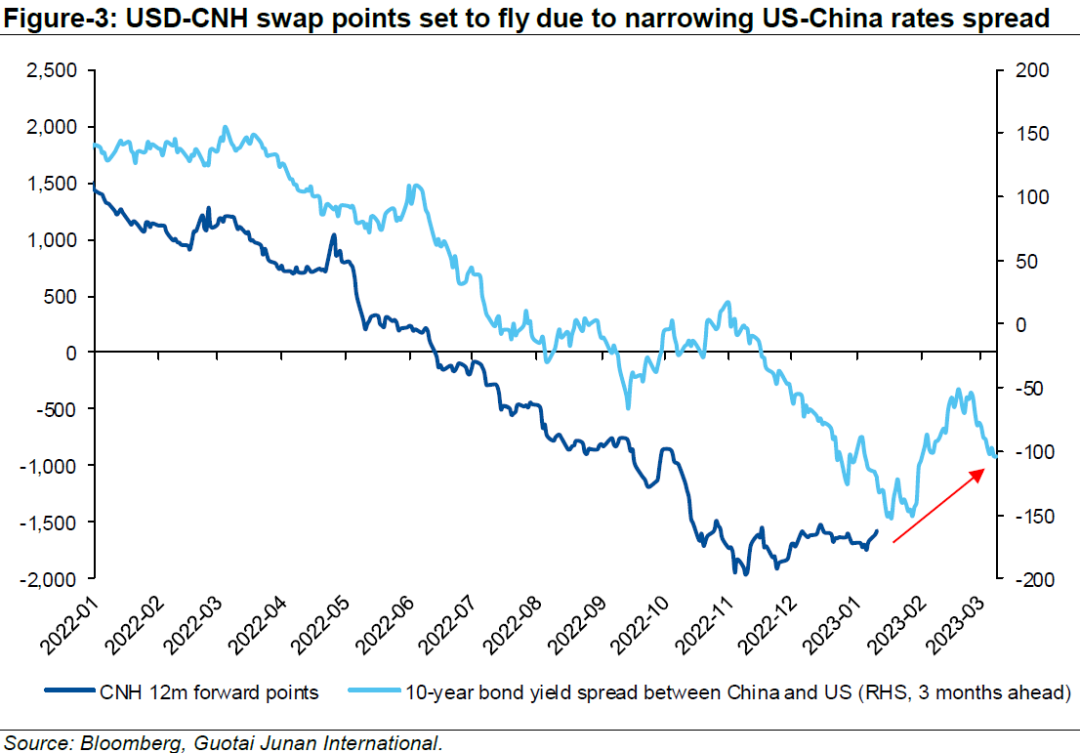

forward points, theoretically speaking, should be a reflection of the interest

rate differentials. From this perspective, as the Fed is about to finalize its

tightening cycle, it makes sense to expect the US-China rates differentials to

narrow, particularly as recession risk is mounting in the US. From

China’s side, while we do expect further policy easing by the Chinese central

bank in the coming year, improving expectations on economic growth suggests

that market interest rates for CNY are bias to the upside. All

told, we believe that it is time to enter a long position in USD-CNH forward

points. If history is any guide, we believe the one-year USD-CNH is heading

towards -1,000 pips, from around -1,600 pips currently. Further upside cannot

be discounted.The

Chinese currency has been on a rapid upward trajectory since last November.Entering 2023, both CNY and CNH continued the stellar performance, with the

6.70 mark looming in sight. China’s swift Covid reopening has significantly

boosted market sentiment, in the meantime, investors have once again embraced

China assets, as the H-share benchmark index has jumped by more than 40% since

last November. In the

meantime, the official CNY index also climbed, with the CFETS RMB index back to

the 100 mark. However, the overall index is still well below the levels seen in

the majority of 2022, suggesting that the Chinese currency might still have

upside potential if China’s growth momentum accelerates. The upside potential,

in our view, not only indicates that the Chinese currency would continue to

appreciate, but also implies a sharp narrowing of USD-CNY forward points.

The

forward points, theoretically speaking, should be a reflection of the interest

rate differentials. From this perspective, as the US Federal Reserve (the

"Fed") is about to finalize its tightening cycle, it makes sense to

expect US-China rates differentials to narrow, particularly as recession risk

is mounting in the US. While the markets are divided on whether the US economy

will see a recession or a soft landing (as wage growth appears to be slowing),

both point to that a Fed pivot is underway. Therefore, the dollar rates are

likely to have peaked and would go lower, especially in the short tenor that is

more sensitive to monetary policy stance. In the end, this will result in

narrowing USD-CNH swap points.

From

China’s side, while we do expect further policy easing by the Chinese central

bank in the coming year, the improving expectations on economic growth suggest

that market interest rates for CNY are bias to the upside. As credit demand is

likely to increase as economic growth picks up, some sort of liquidity

tightening can be expected as well.

All told,

we believe that it is time to enter a long position in USD-CNH forward points.As the US-China rates differentials for the 10-year tenor have already been

narrowing, we think that the one-year USD-CNH swap points will catch up as

well. If history is any guide, we believe the one-year USD-CNH is heading

towards -1,000 pips, from around -1,600 pips currently. Further upside cannot

be discounted.

This Research Report does not constitute an invitation or offer to acquire, purchase or subscribe for securities by Guotai Junan Securities (Hong Kong) Limited ("Guotai Junan"). Guotai Junan and its group companies may do business that relates to companies covered in research reports, including investment banking, investment services, etc. (for example, the placing agent, lead manager, sponsor, underwriter or invest proprietarily).Any opinions expressed in this report may differ or be contrary to opinions or investment strategies expressed orally or in written form by sales persons, dealers and other professional executives of Guotai Junan group of companies. Any opinions expressed in this report may differ or be contrary to opinions or investment decisions made by the asset management and investment banking groups of Guotai Junan.Though best effort has been made to ensure the accuracy of the information and data contained in this Research Report, Guotai Junan does not guarantee the accuracy and completeness of the information and data herein. This Research Report may contain some forward-looking estimates and forecasts derived from the assumptions of the future political and economic conditions with inherently unpredictable and mutable situation, so uncertainty may contain. Investors should understand and comprehend the investment objectives and its related risks, and where necessary consult their own financial advisers prior to any investment decision.This Research Report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Guotai Junan and its group companies to any registration or licensing requirement within such jurisdiction.© 2023 Guotai Junan Securities (Hong Kong) Limited. All Rights Reserved.27/F., Low Block, Grand Millennium Plaza, 181 Queen’s Road Central, Hong Kong.Tel.: (852) 2509-9118 Fax: (852) 2509-7793 This Research Report does not constitute an invitation or offer to acquire, purchase or subscribe for securities by Guotai Junan Securities (Hong Kong) Limited ("Guotai Junan"). Guotai Junan and its group companies may do business that relates to companies covered in research reports, including investment banking, investment services, etc. (for example, the placing agent, lead manager, sponsor, underwriter or invest proprietarily).Any opinions expressed in this report may differ or be contrary to opinions or investment strategies expressed orally or in written form by sales persons, dealers and other professional executives of Guotai Junan group of companies. Any opinions expressed in this report may differ or be contrary to opinions or investment decisions made by the asset management and investment banking groups of Guotai Junan.Though best effort has been made to ensure the accuracy of the information and data contained in this Research Report, Guotai Junan does not guarantee the accuracy and completeness of the information and data herein. This Research Report may contain some forward-looking estimates and forecasts derived from the assumptions of the future political and economic conditions with inherently unpredictable and mutable situation, so uncertainty may contain. Investors should understand and comprehend the investment objectives and its related risks, and where necessary consult their own financial advisers prior to any investment decision.This Research Report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Guotai Junan and its group companies to any registration or licensing requirement within such jurisdiction.© 2023 Guotai Junan Securities (Hong Kong) Limited. All Rights Reserved.27/F., Low Block, Grand Millennium Plaza, 181 Queen’s Road Central, Hong Kong.Tel.: (852) 2509-9118 Fax: (852) 2509-7793

|